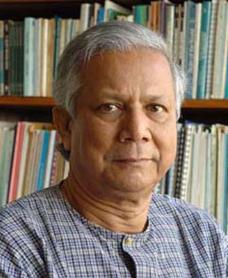

Yunus is founder and chief executive of Grameen Bank, a microfinance entity that has singlehandedly transformed the landscape of thought and practice about how women can be empowered to improve their lives and the lives of their children, and, of yes, the lives of their reluctant husbands... ;-)

Yunus is founder and chief executive of Grameen Bank, a microfinance entity that has singlehandedly transformed the landscape of thought and practice about how women can be empowered to improve their lives and the lives of their children, and, of yes, the lives of their reluctant husbands... ;-)See the Nobel press release.